Capital gains calculator for home sale transactions

It calculates both Long Term and. The capital gain for the property happens on the date of the sale contract not the date of settlement.

Short Term Long Term Capital Gains Tax Calculator Taxact Blog

Calculate your capital gains taxes and average capital gains tax rate for the 2022 tax year.

. Capital gains taxes on. The calculator computes both for 2022 and 2021. Our calculator can be used as a long-term capital gain calculator by increasing the duration of the investment.

The tax rate you pay on long-term capital gains can be 0 15 or 20 depending. For the exclusion if you. If your capital losses exceed your capital gains the amount of the excess loss that you can claim to lower your income is the lesser of 3000 1500 if married filing separately or your total.

In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. Frequently Asked Question Subcategories for Capital Gains Losses and Sale of Home. Real estate property includes residential.

2022 long-term capital gains taxes can range from 0 to 20 based on your tax bracket and filing status. If this is a negative number youve made a loss. More help with capital gains calculations.

Your tax rate is 15 on long-term capital gains if youre a single filer earning between 40401 and 445850 married filing jointly earning between 80801 and 501600 or. If this is a. How long you own a rental property and your taxable income will determine your capital gains tax rate.

Forbes Advisors capital gains tax calculator helps estimate the taxes youll pay on profits or losses on sale of assets such as real estate stocks bonds. Gains on the sale of collectibles rental real estate income collectibles antiques works of art and stamps are taxed at a maximum rate of 28. 2022 real estate capital gains calculator gives you a fast estimate of the capital gains tax.

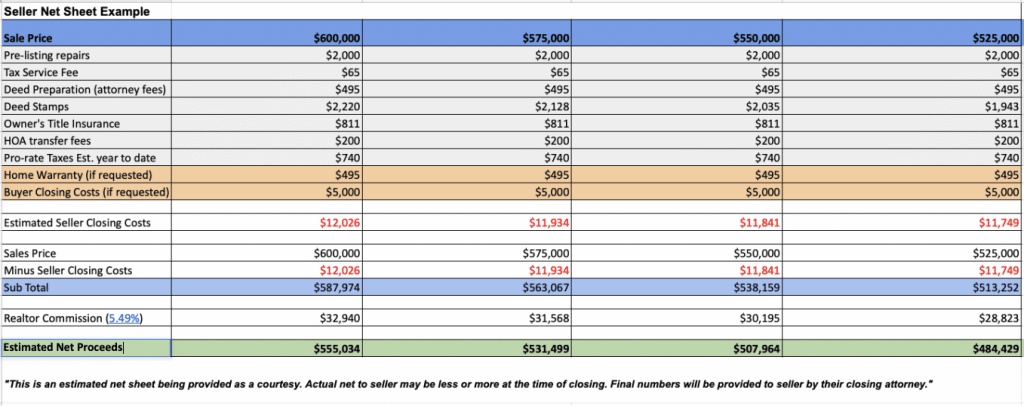

Property Basis Sale of Home etc Stocks Options Splits Traders Mutual Funds. The standard costs of the home sale transaction paid at closing. Capital Gains Tax on Sale of Property.

2022 capital gains tax rates. September 12 2022 We have compiled an Excel based Capital gains calculator for Property based on new 2001 series CII Cost Inflation Index. Learn more about the home sale calculator line items to understand the true costs of selling a house and your realistic.

For example if contracts are exchanged on 4 June 2022 and settlement happens. The calculator on this page is designed to help you estimate your. To work out the gain you simply deduct the cost basis of the house from the net proceeds you receive from the sale.

Short-term investments held for one year or less are taxed at your. 2021 capital gains tax calculator.

Crypto Mining Taxes What You Need To Know

Short Term Long Term Capital Gains Tax Calculator Taxact Blog

Real Estate Capital Gains Tax Calculator For Nyc Interactive Hauseit

Real Estate Capital Gains Tax Calculator For Nyc Interactive Hauseit

Capital Gains Tax Rate In California 2022 Long Short Term Seeking Alpha

Seller S Net Sheet The Ultimate Guide

Real Estate Capital Gains Tax Calculator For Nyc Interactive Hauseit

Real Estate Tax Reform The Potential Impact Of A Capital Gains Tax Hike

Real Estate Capital Gains Tax Calculator For Nyc Interactive Hauseit

Real Estate Capital Gains Tax Calculator For Nyc Interactive Hauseit

Real Estate Capital Gains Tax Calculator For Nyc Interactive Hauseit

Real Estate Capital Gains Tax Calculator For Nyc Interactive Hauseit

Cryptocurrency Taxes What To Know For 2021 Money

Real Estate Capital Gains Tax Calculator For Nyc Interactive Hauseit

Real Estate Capital Gains Tax Calculator For Nyc Interactive Hauseit

Seller S Net Sheet The Ultimate Guide

Understanding The Lifetime Capital Gains Exemption And Its Benefits Davis Martindale Blog